Car insurance is an essential requirement for drivers across Canada, designed to provide financial protection against accidents, theft, and other incidents on the road. TD Canada Trust, one of Canada’s leading financial institutions, offers a range of vehicle insurance products through TD Insurance. Known for their customization options, competitive pricing, and robust customer support, TD Canada Trust vehicle insurance offers solutions tailored to the diverse needs of Canadian drivers.

Overview of Mandatory and Optional Coverage Options

When choosing car insurance, it’s vital to understand the difference between mandatory and optional coverage options, as they vary by province.

Mandatory Coverage Options:

- Liability Coverage: Protects against the cost of bodily injury or property damage to others if you’re at fault in an accident.

- Accident Benefits: Covers medical expenses and lost income if you or passengers are injured in an accident, regardless of fault.

- Uninsured Motorist Coverage: Provides protection if you’re in an accident with an uninsured driver.

- Direct Compensation for Property Damage (DCPD): In certain provinces, DCPD covers repairs to your vehicle in no-fault accidents.

Optional Coverage Options:

- Collision Coverage: Pays for repairs or replacement if your car is damaged in a collision.

- Comprehensive Coverage: Protects your car against damage from events other than collision, such as theft or natural disasters.

- Special Endorsements: Additional coverages, such as Accident Forgiveness, rental car coverage, and roadside assistance, can be added for extra protection.

Unique Features of TD Canada Trust Vehicle Insurance

TD Canada Trust offers some unique features that differentiate its vehicle insurance:

- Accident Forgiveness: This option ensures that your premium won’t increase after your first at-fault accident, provided you qualify.

- TD MyAdvantage Program: A usage-based insurance program that rewards safe driving habits with potential premium discounts.

- Discounts and Savings: TD offers a range of discounts, including multi-vehicle discounts, bundling home and auto insurance, and safe driving rewards.

- Claims Tracker: TD’s app allows customers to track their claims in real time, giving peace of mind and transparency during the process.

Customization Options with TD Vehicle Insurance

TD Canada Trust allows policyholders to customize their coverage to fit their specific needs, making it easier to find a balance between comprehensive coverage and affordability. Examples include:

- Loss of Use Coverage: Provides a rental car or alternative transportation if your vehicle is damaged.

- Rental Vehicle Coverage: Extends your coverage to a rental vehicle.

- Grand Touring Coverage: Covers travel outside of your home province, which can be useful for frequent travelers.

TD’s Online Tools for Getting Quotes and Managing Policies

TD Canada Trust offers convenient online tools for getting insurance quotes and managing policies, making it easier for customers to explore options and find a policy that fits their needs:

- How to Get an Accurate Quote: Factors like driving history, vehicle type, and location all impact premiums.

- Online Quoting Tools: With TD’s website and app, you can quickly receive a quote tailored to your specific driving history and vehicle.

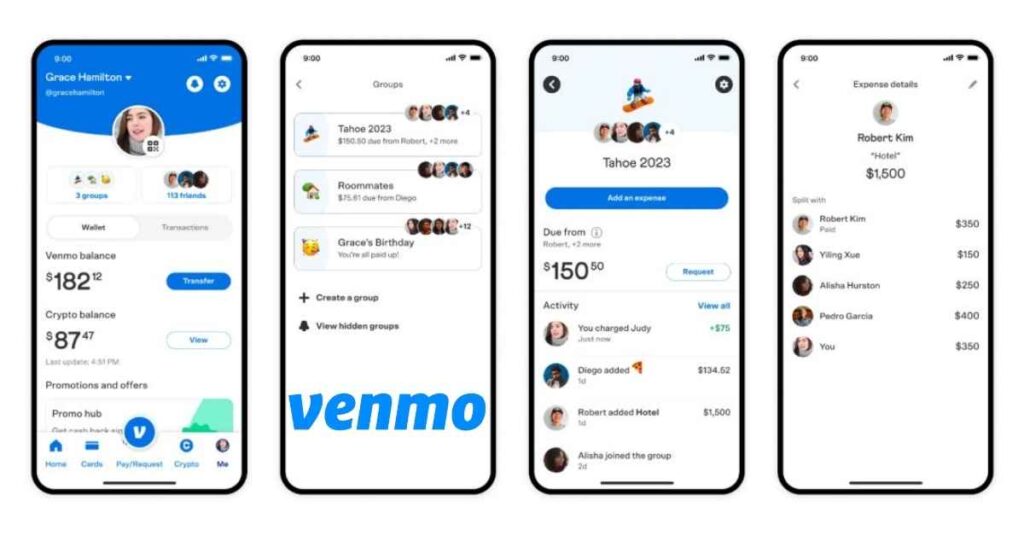

- Insurance App Features: TD’s app enables customers to view their policy details, make payments, access support, and track claims.

Factors Affecting Car Insurance Premiums with TD

Several factors determine your car insurance premium, including:

- Driving History: A clean driving record can lead to lower premiums, while accidents or claims can increase costs.

- Vehicle Specifications: Certain makes, models, and years may have higher premiums based on repair costs and safety features.

- Location: Rates can vary by province and city, with urban areas often having higher premiums.

- Driver Age and Experience: Younger or less experienced drivers typically pay higher premiums.

Tips for Choosing the Right Coverage

Choosing the right car insurance policy involves understanding your own driving habits and needs:

- Assessing Personal Needs: Consider factors such as how often you drive, where you drive, and the type of vehicle you own.

- Comparing Coverage: Look at the coverage details of TD Canada Trust’s options against other insurers to ensure you get the best value for your money.

- Reviewing Coverage Annually: Adjusting your coverage yearly ensures it aligns with any changes in your driving habits or life circumstances.

Advantages of Bundling Insurance with TD Canada Trust

TD Canada Trust offers significant savings when you bundle auto insurance with other policies, such as home or tenant insurance. Not only does bundling reduce premiums, but it also simplifies policy management and can qualify you for additional discounts.

TD Canada Trust’s Commitment to Sustainable and Responsible Insurance

TD is committed to environmentally responsible practices and customer education:

- Environmental Initiatives: TD supports eco-friendly driving habits and offers options that consider vehicle emissions and sustainability.

- Support for Electric Vehicles: With the rise of electric vehicles, TD is adapting coverage options to accommodate these changes.

FAQs About TD Canada Trust Vehicle Insurance

What is covered under TD’s Accident Forgiveness feature?

Accident Forgiveness prevents your premium from increasing after your first at-fault accident, helping maintain affordable rates.

How can I qualify for discounts with TD Canada Trust vehicle insurance?

Discounts are available for multi-vehicle policies, bundling with home insurance, good driving records, and more.

What is the TD MyAdvantage Program?

MyAdvantage is a usage-based program where you can save money by practicing safe driving habits, monitored through an app.

Can I manage my vehicle insurance policy online with TD?

Yes, TD offers an app and online portal where you can view policy details, make payments, file claims, and track claim status.

Does TD Insurance cover rental vehicles?

Yes, TD offers optional rental vehicle coverage, which extends your policy protections to rentals.